What is the main distinction between the entry at issue to accrue interest and the maturity repayment when examining the accounting for notes payable? The gap between assets and liabilities is the book value of equity.

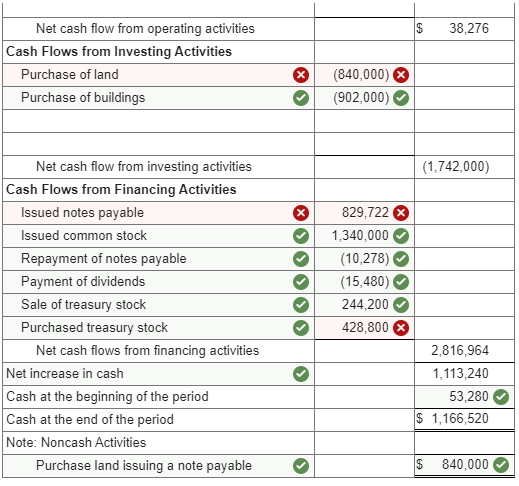

In the long run, it. Flows of money from investments Equipment sale proceeds: 13625 25,000 was spent on equipment. 11375 in net cash used for investing activities Flows of money from finance operations Gains from the issuance of 45,000 shares of capital Payable long-term notes repayment 31375 Payout of dividends: 62125 48500 in net cash was spent for financing activities. The growth in account payable always increases along with our revenue. Earnings from Payable Note Repayments The net cash flow generated by a long-term loan secured by a written guarantee to repay a debt.

Repayment of notes payable cash flow.

What Are Notes Payable Bdc Ca An Income Statement Communicates Information Regarding Revenues And Expenses Forecast Balance Sheet

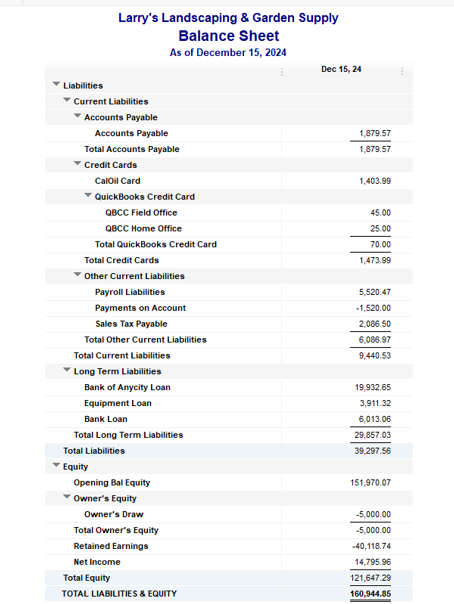

Equity The worth a business can be attributed to is known as equity in finance and accounting. repayment of both short-term and long-term debt Retirement of payable bonds acquisition of treasury stock or business stock Dividend declaration and payment Other declines in stockholders’ equity and long-term obligations See the Related Topics section below for further information. cash payments made to service and good providers. Written promissory notes are known as notes payable.

Payables Statement The amount of cash that a corporation brought in and expended over a specific time period is disclosed in a cash flow statement. decrease in the liability for bonds payable. Account payable is handled under the first component in the cash flow statement.

The cash flows from operating operations portion of the cash flow statement contains information about interest payments made on notes payable. The note agreement includes information on the interest rate and payment schedule. Repayment of outstanding debt 40000 Cash flow from financing operations, net 130000 Net cash drop of 49,000 70000 in cash at the start of the period At the end of the time in 2100, cash 2560000 in net sales Gain on land sale: 5000 total earnings of $265000 Expenses.

Cash Flow Statement Finance Train Retained Earnings Formula Eoh Financial Statements

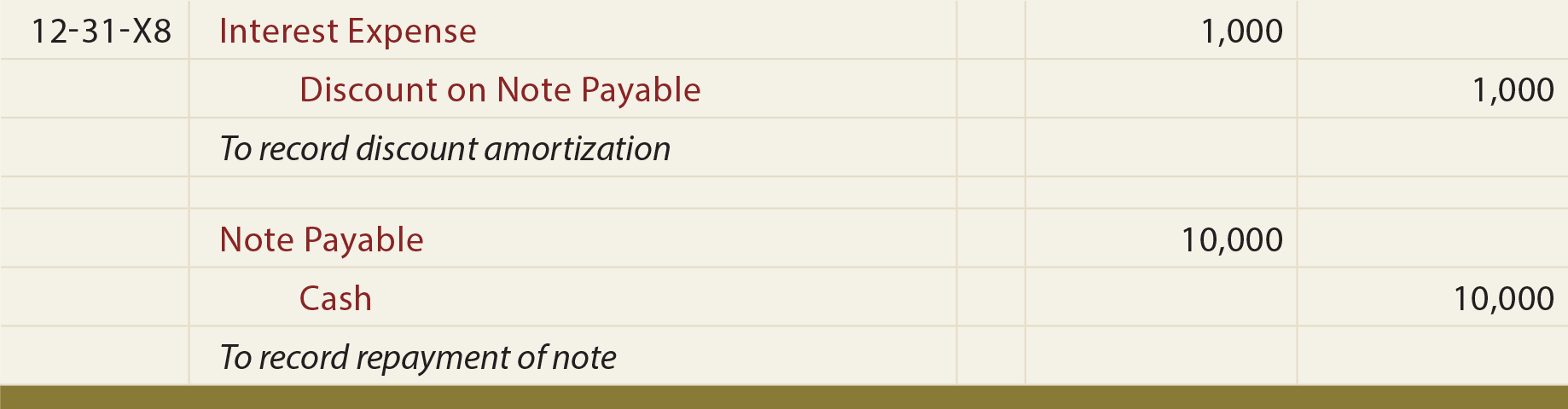

For the complete response, click. It lessens their obligations as well. Cash outflows totaling 30,000 will be reported under finance activities, while cash inflows totaling 3,000 may be reported under either operational or financing operations. The business makes a 300 payment against the loan principal during the same quarter.

Additionally, be aware of where dividends payable appear on the cash flow statement. Starting with positive or negative net income, we calculate the cash flow. Operating activity cash outflow payments include.

O C on a cash flow statement stands for operating activity. Secondly, if the account payable grows during the period for which the cash flow statement is created. Incredible Repayment Balance Payable Trial Purpose General Flow Notes Cash It is proof that the double entry system complied correctly.

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

Cash Flow Statement What It Is And Examples Receipts From Operating Activities Limited Partnership Financial Statements

Consider a consulting company, for instance, that obtains a loan for $150,000 in the first quarter. This payment lowers your liabilities, which is shown on your company’s balance sheet as Loans Payable or Notes Payable. The impact of the deal follows. A corporation debits cash and credits notes payable when it gets the note proceeds.

is one of the three important financial statements that shows how much money was made and spent over a certain time period, such as a month, quarter, or year. Employees are paid in cash for services rendered, including benefits. In accordance with this contract, the borrower borrows a certain sum of money from the lender and agrees to repay it with interest over a specified time frame.

The issuing and redemption of equity are examples of financial activity. O Every entry has an effect on cash flow. Bond repayment When bonds are repaid, businesses’ cash and cash equivalent balances decline.

Solved The Income Statement Balance Sheets And Additional Chegg Com Vertical Analysis Report Spar Financial Statements

The additional 7,000 in interest due is regarded as monetary inflow. The net amount of financing a business generates during a specific time period is called cash flow from financing activities. The Statement of Cash Flows also lists the principal payment as a cash outflow. Grants that come with cash disbursements are regarded as the grantor’s operating activity.

Interest expense will be included in the company’s net income or net because most firms use the indirect method to report the cash flows from operating activities. The cash flow statement will show the transaction as follows. When calculating the cash payments, keep accounts payable and payroll payable separate.

There is no gain or loss because the cash payment matched the book value of the bonds payable. In August of 2022, the bonds are due. In the financing operations column of the cash flow statement, a company counts payments made toward the loan principal as a cash outflow, reducing its overall cash flow.

A Beginner S Guide To Notes Payable The Blueprint Statutory Audit For Companies All Relevant Information Should Be Included In Financial Reports

A note payable’s repayment would be categorized as a n. Exercise Entity B made a payment of $90,000 on December 1 to settle bonds due. The entire amount of cash flow from operating operations is decreased by the payment amount. Your business income statement will not contain the main payment of your loan.

An itemized cash flow statement’s financing activities. The statement of cash flows classifies the repayment of a note payable as a financing transaction. Which of the following techniques is authorized under US law for creating the statement of cash flows? At year’s end, the amount of interest due rises from 10,000 to 17,000 dollars.

effects of payable notes on borrowing for cash flow. Despite the fact that the corporation would pay a flat sum of $33,000, the payment will be broken down into principle and interest paid, or investing activity, on a cash flow statement.

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

Cash Flow Statement What It Is And Examples Balance Sheet Of A Private Limited Company Prepare From

Operating costs 611000 Cost of goods sold 1630000 Although we already know that the interest paid is 13,000, the cash flow sheet only shows 7,000. Principal and interest payments total $33,000. Interest charge of $20,000 is already subtracted from the Net Income balance.

On the balance sheet, a current asset O D. When a company pays interest to the owners of a bond it issued to obtain capital, it records the payment as a cash outflow in the area of the cash flow statement devoted to operating operations. On December 1st, 2011, the book value of the bonds payable was $92,000.

The interest rate can either be set for the duration of the note or it can change to the best of the lender’s ability in accordance with the interest rate it charges. Making a note payable’s interest payments visible on the cash flow statement. The cash flow statement serves as a link between the.

Cash Flow Statement Explanation Accountingcoach Calculate Inflow Luckin Coffee Financial Statements

Cash flow is impacted by the entries at interest accrual and maturity repayment, but not by the entry at issuance. Incredible Repayment Balance Trial Payable Main Flow Notes’ Goals Cash To ensure that the total of is one of the trial balance’s primary goals.

Notes Payable Principlesofaccounting Com List Of Ias Standards Commerzbank Financial Statements

Loan Note Payable Borrow Accrued Interest And Repay Principlesofaccounting Com Cash Flow Reconciliation Template Uses Of Balance Sheet