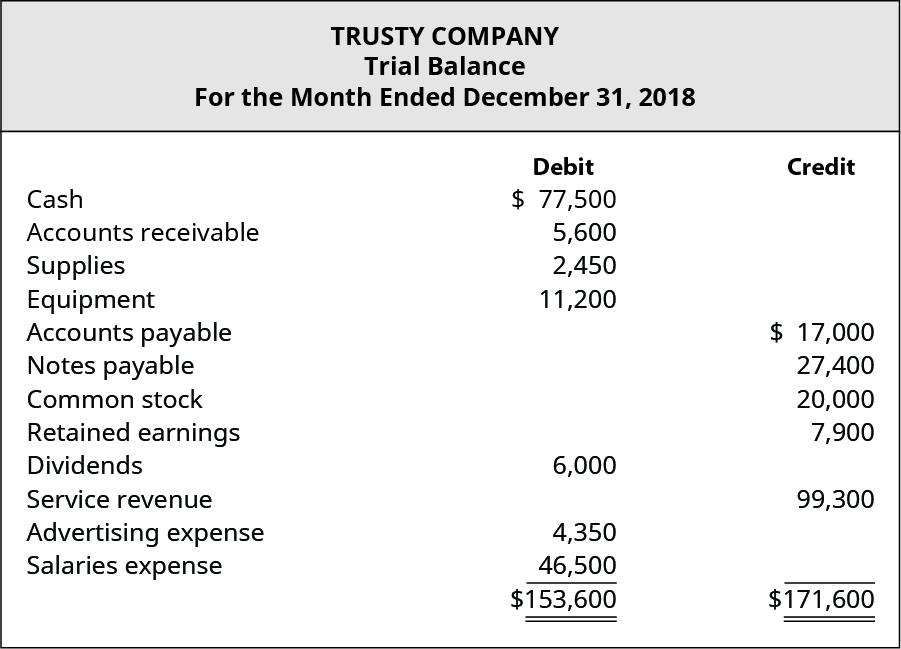

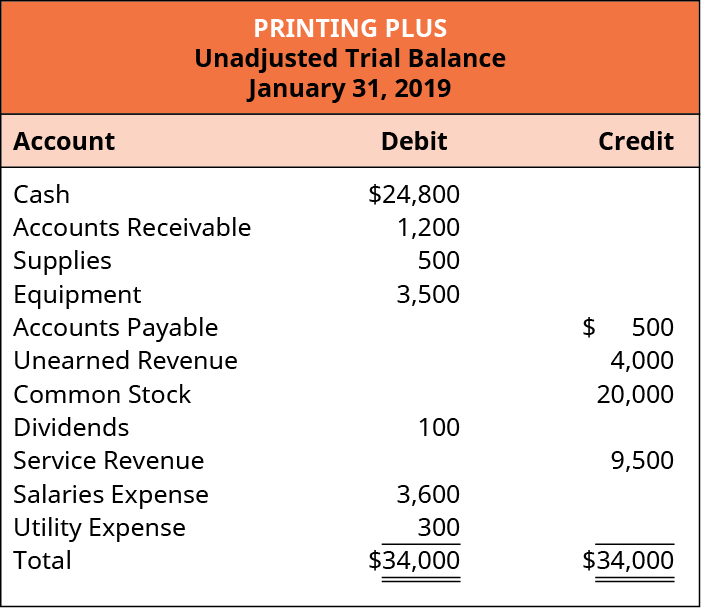

A trial balance is a statement showing the balances or total of debits and credits of all the accounts in the ledger with a view to verify the arithmetical accuracy of posting into the ledger accounts. Worksheet Donald Electronics an electronics repair shop prepared the unadjusted trial balance at the end of its first year of operations shown below.

The rule to prepare trial balance is that the total of the debit balances and credit balances extracted from the ledger must tally. Name of Account LF. Cat the end of an accounting period. Journalize the adjusting entries using the following adjustment data and also by reviewing the journal entres prepared in Requirement 1.

A trial balance is prepared to.

Adjusted Trial Balance Format Preparation Example Explanation Cash Flow Statement For Nonprofit Organization Big 3 Financial Statements

But a trial balance wont be able to guarantee that accounts are free from any error. The following are the steps to take when preparing a trial balance for your business. The expected result is ____. This is an essential phase before proceeding further to prepare the final accounts at the end of accounting period.

Donald Electronics Trial Balance April 30 2019 Cash 3450 Accounts Receivable 22500 Supplies 5400 Equipment Accounts Payable. Trial Balance is a list of closing balances of ledger accounts on a certain date and is the first step towards the preparation of financial statements. A cash account balance of zero.

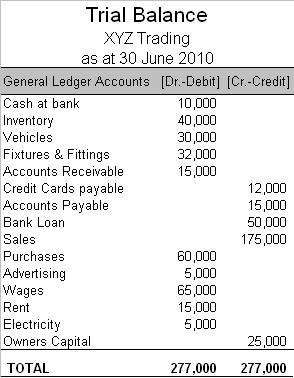

The trial balance is prepared after posting all financial transactions to the journals and summarizing them on the ledger statements. Using the trial balance all the income and expenses related ledger accounts are compiled to create Profit and loss account and rest are used for preparing a balance sheet. Trial balances are most commonly prepared at the end of an accounting period.

Unadjusted And Adjusted Trial Balance Financiopedia Financial Position Definition Profit Loss Application

Before you start off with the trial balance you need to make sure that every ledger account is balanced. That cash and expense accounts have equal balances. This phase helps to verify whether sum of the debit balances is equal to the sum of the credit balances. A Trial balance is prepared.

This is an optional field and is only available if you turn on book code functionality on the General Options page and you create book code values with the Book Codes and Book Code Group pages. If the total debits equal the total credits the trial balance is considered to be balanced and there should be no mathematical errors in. The trial balance is prepared on a worksheet with two columns debit balance column and credit balance column.

However Trial Balance is generally prepared at quarterly interval in practice to check the arithmetic accuracy of accounts. Prepare an unadjusted trial balance as of December 31 2024 4. Preparation of trial balance is to ensure mathematical correctness of the transactions recorded.

Prepare Financial Statements Using The Adjusted Trial Balance Principles Of Accounting Volume 1 Which Are Shown On A Sheet Is Statement

Trial Balance is a statement of ledger. Bafter each journal entry is posted. A After preparation financial statement. The trial balance is prepared at the yearend on a particular date.

Under this method a trial balance is prepared by showing the balances of all ledger accounts and then totalling up the debit and credit columns of the trial balance to assure their correctness. Asked Feb 26 2020 in Health Professions by kellie. Proves the equality of the total debit balances and total credit balances of ledger accounts after all adjustments have been made.

With contemporary accounting software the trial balance is mostly a thing of the past since the software prevents errors from being made in the first place. LO 7Which types of accounts will appear in the post-closing trial balance and have a balance. Accumulated depreciation unadjusted trial balance represents the total amount of property and equipment used in the past ie the total amount of depreciation expense recognized Adjusting journal entries record events that occur during the accounting period but that have not yet been recorded by the end of the period.

Unadjusted Trial Balance Format Uses Steps And Example Financial Statement Analysis & Valuation Pdf Combined Statements Gaap

Customarily a trial balance is prepared. The format of the trial balance is as mentioned below. Aat the end of each day. A Trial Balance has no limitations -.

The trial balance is prepared before you make any adjusting entries. Trial balance is an important statement in the accounting process which shows the final position of all accounts and helps in preparing the final statements. Preparing a trial balance for a company serves to detect any mathematical errors that have occurred in the double-entry accounting system.

Trial Balance under balance method is known as. These balances can be prepared either manually or by using an accounting system on a computer. It is not an official financial statement.

Prepare A Trial Balance Principles Of Accounting Volume 1 Financial Notes Statement Analysis Where Is Research And Development On The Income

In a manual accounting system the trial balance is prepared frequently in order to discover errors made during the accounting cycle. Features of trial balance. B After recording transactions in subsidiary books. Is a required financial statement under generally accepted accounting principles.

That credit accounts and debit accounts have equal totals. Accounting questions and answers. It is prepared again after the adjusting entries are posted to ensure that the total debits and credits are still balanced.

All the accounts having debit balances are. The trial balance is made to ensure that the debits equal the credits in the chart of accounts. Preparation of Trial Balance Trial balance is prepared after the transactions are first recorded in the journal and then subsequently posted in the general ledger.

Adjusted Trial Balance Explanation Format Example Accounting For Management Basics Marketing Consultant Plan Financial Projections Sample Statement Of Earnings

Donly at the inception of the business. C After posting to ledger is complete. A Trial Balance contains the balance of. In double entry bookkeeping a trial balance is prepared.

In addition to error detection the trial balance is prepared to make the necessary adjusting entries to the general ledger. A trial balance is a conglomerate of or list of debit and credit balances extracted from various accounts in the ledger including cash and bank balances from cash book. Trial balance is the steppingstone for preparing all the financial statements such as Trading and Profit loss account balance sheet etc.

The expected result is ____. The trial balance can still be use Continue Reading. The account balances are used because the balance summarises the net effect of all transactions relating to an account and helps in preparing the financial statements.

Prepare A Trial Balance Principles Of Accounting Volume 1 Financial General Expenses In How Does The Sheet Related To Income Statement

Post adjusting entries to the T-accounts Adjustment data a. Prepare a worksheet as of December 31 2024 5. An adjusted trial balance a. It is usually prepared at the end of an accounting period to assist in the drafting of financial statements.

Is prepared after the financial statements are completed. The trial balance is prepared for. Debit Balance Amount Credit Balance Amount.

Click to see full answer Also to know is how do you set up a trial balance. Balance each ledger account. D After posting to ledger is complete and accounts have been balanced.

The Trial Balance Principlesofaccounting Com Accounts Payable Is Classified On Sheet As A Xpo Logistics Financial Statements

How To Prepare A Trial Balance Accounting Cycle Errors Reflected In The Frs Cash Flow Statement South32 Financial Statements