When a company plans to hire staff, this information is equally crucial. When it comes to business administration, small business owners frequently fall into a few types.

Select Obtain company information, launch COMPANY DOSSIER, search for the desired company, then select FINANCIALS. Overview of the last three years’ major financial ratios on the left column 2. It is the amount of money that your company made from selling goods or rendering services after deducting costs. What You Should Know About Balance Sheet Fundamentals There are currently 7 million individuals, a 4x increase.

Financial statements of small companies.

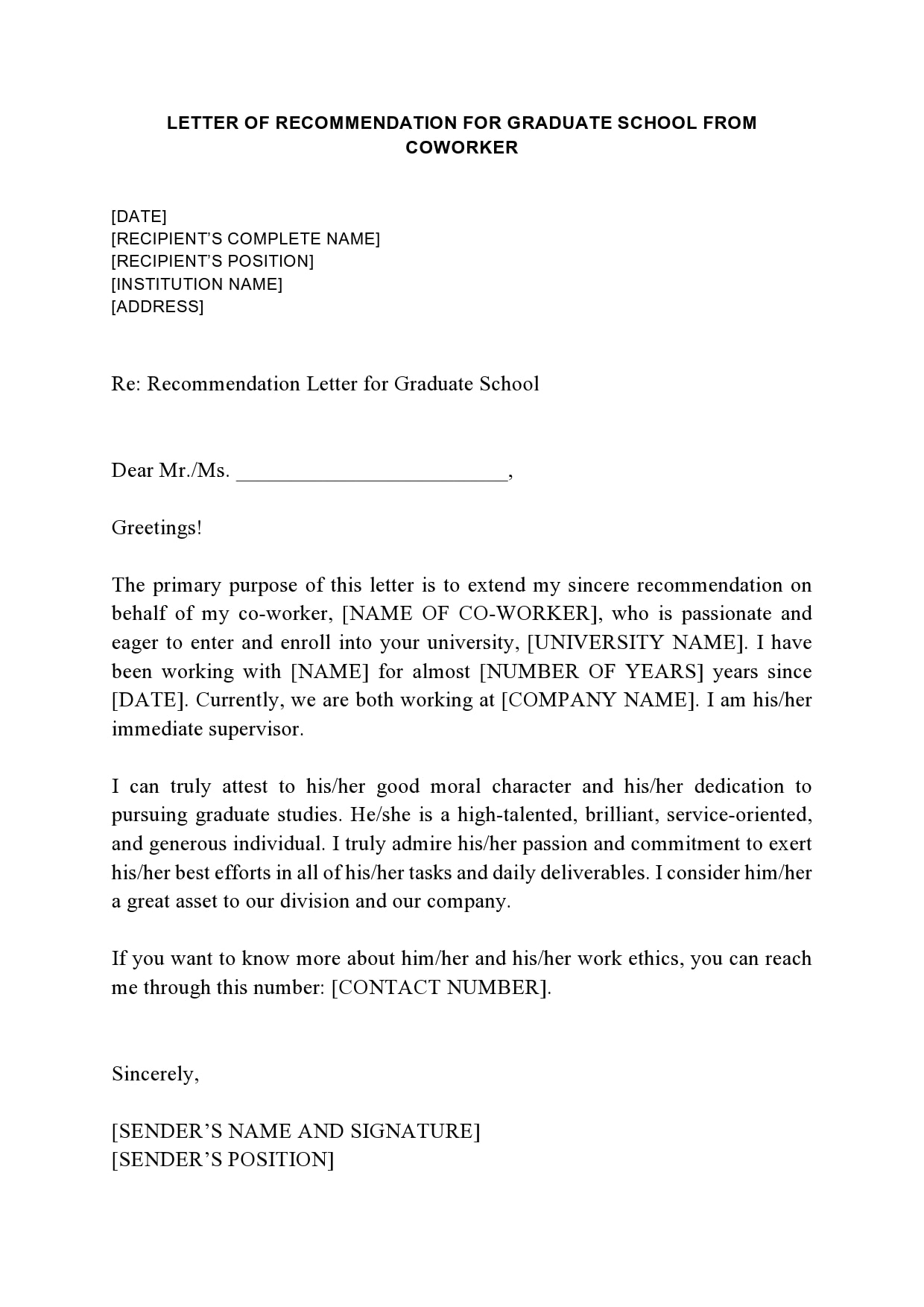

Printable Profit And Loss Statement Free Word Templates Small Business Accounting Bookkeeping Xom Income Gold Fields Financial Statements

Choose Search By Content Type and then under COMPANIES directory choose SEC FILINGS. Enter the firm name and choose either the 10-K or the unaudited quarterly financials. Financial statements outline a small business’s whole operational performance as well as its present financial condition and cash flow. You can simply find out information like this by looking at your monthly bill, for instance, if you want to see how much your company spends and earns each month. They produce a paper trail of the financial activity of a corporation.

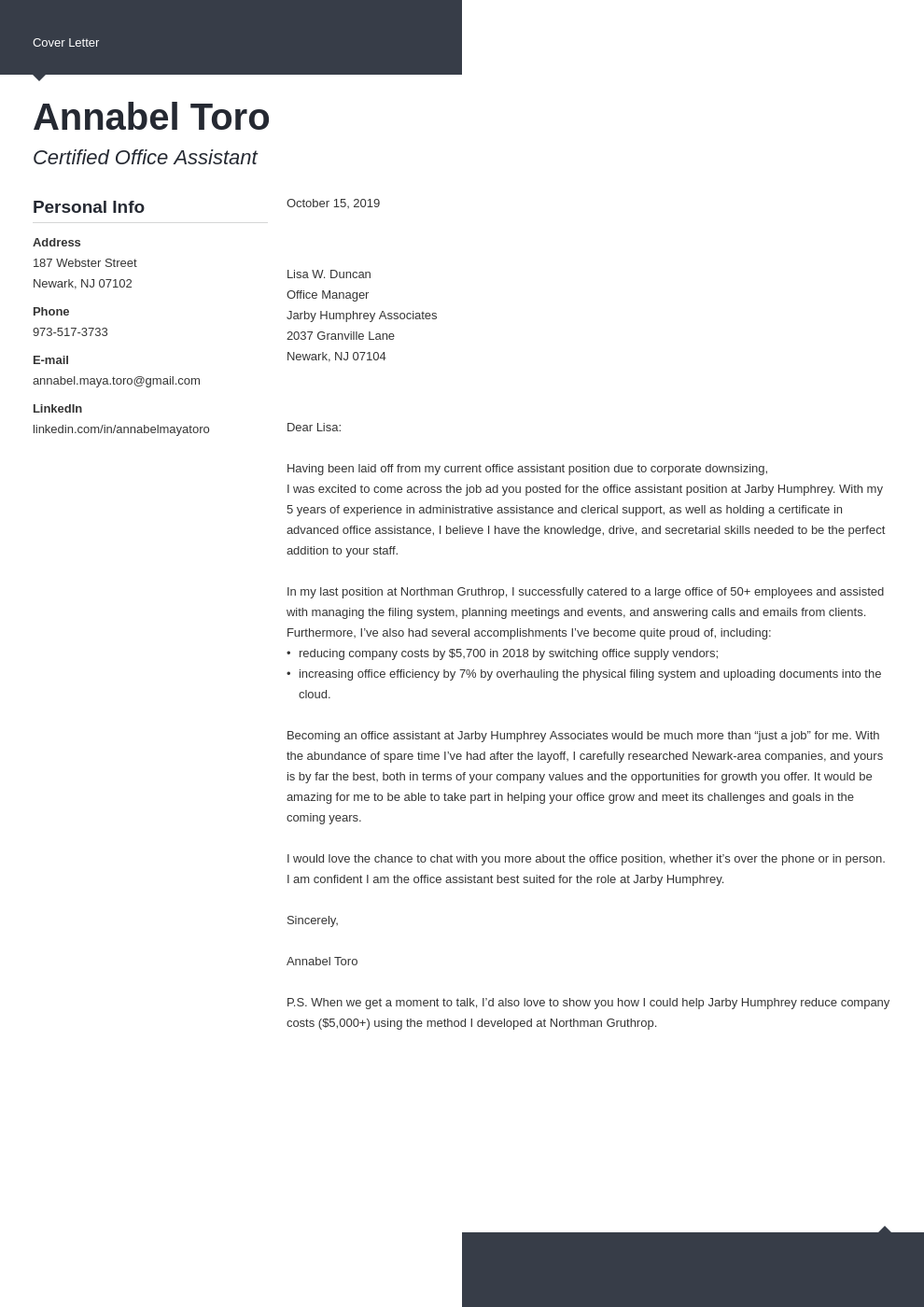

Accounting Reports for Small Businesses. Large firms, as opposed to small enterprises, use more complicated financial ratios when providing financial information for comparison. The main component of your company’s financial statements is the income statement, sometimes referred to as the profit and loss or PL statement.

They provide a summary of the company’s key financial accounting data. When you wish to manage your finances better, a business and financial statement template for small businesses might be useful. It demonstrates.

Excel Spreadsheet For Accounting Of Small Business And Intended Balance Sheet Templa Template Spreadsheets Financial Ratios Interpretation Account Receivable Debit Or Credit In Trial

You will be able to share your information with potential investors through your business’ financial statements. These ratios include debt to equity, return on investment, and return on assets, as examples. Statements of Financial Position for Small Businesses Financial statements are used to depict economic activity and status in relation to a specific date and time period. Along with the cash flow statement, the balance sheet and the income statement are the three primary financial statements that small firms create to report on their financial performance.

Researchers from the Financial Education Research Foundation discovered that 83 businesses reported an audit fee average of 9 in their 2018 survey. A business owner should also include information regarding the payment of employee taxes to the state in where the business is formed and is based in their financial statements, as an example. How much do small firm audited financial statements cost.

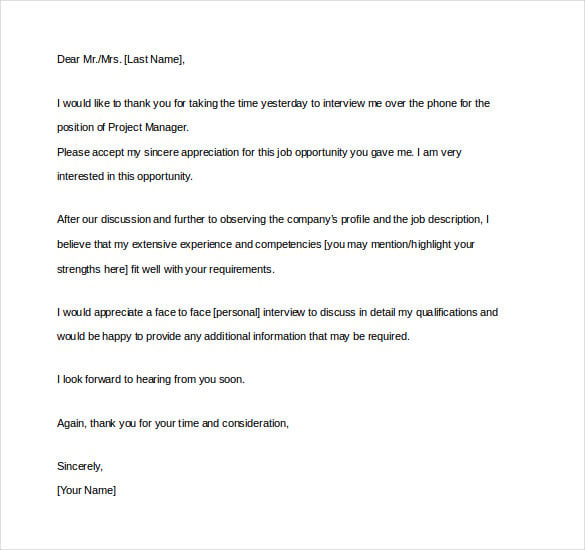

Customize, Download, and Print Right Away – A Contemporary Approach To Paperwork – Simple Forms This statement normally sums up the operations of your company over a. Accounting professionals keep track of financial transactions and present the data in financial reports in a clear manner.

Example Of Financial Statement Small Business And Sample For Sma Income Personal Profit Loss Current Assets To Total Relationship Balance Sheet

Many business owners fail to keep track of how their income and expenses compare. These ratios are the results of dividing two financial statements by each other. The first kind of small business owner will have all of their financial records organized and will use them to support the growth of their enterprise. It is down 1 from 2017.

Ad Make wise decisions for your company and collaborate effectively with your accountant. Ad 1 In Minutes, obtain a personal financial statement. Because of this, financial statements are crucial.

Retaining clients will guarantee that the company generates sales from not only those clients but also from others who will hear the positive message. Lashing 135 The financial statement is what reveals a company’s net profit or loss for a specific time period. The easiest report to comprehend is certainly the income statement.

Small Business Financial Statement Template Luxury 8 Samples Examples T Personal Debt Investments Long Term Balance Sheet Classification 3 Year Cash Flow Projection

The profit and loss statement, or PL, is another name for the income statement. The owner of a small business has a lot of vital tasks to complete, but obtaining finance can be made easier with an example income statement. The balance sheet is a summary of your assets, liabilities, and market value. 2 Time Saving, Stress Reduction, 100 Free.

How much of the company’s net profit was retained and reinvested is disclosed in this statement. This book is valued $8 million with an average charge of 3. Government accounting firms frequently examine financial statements.

Financial statements are documents that describe a company’s operations and financial performance. The second type is aware of how financial statements should operate but they are never given the opportunity to do so. The balance sheet and the profit and loss statement, often known as an income statement or PL, are the two interim financial statements that are most frequently utilized.

Projected Income Statement Template Beautiful 8 Financial Tripevent Plan Bookkeeping Business Cash Flow Worksheet Coverage Ratio Analysis

A bespoke Financial Management for Small Businesses paper can be delivered by our professionals. Ad Download Or Email Additional Fillable Forms SBA 413 Sign up and subscribe right away. A PL displays your cumulative net profit or loss over time. The tools for simple, intuitive accounting for your small business are provided by FreshBooks.

Income Statement Example Profit And Loss Template What Are The Objectives Of Preparing Financial Statements Ssars 21 Personal

How To Make A Balance Sheet For Small Business An Easy Way Start Is Download This Template Assets And Liabilities On Sample Simple

Free Sample Profit And Loss Statement Template Bookkeeping Business Checklist 3 Year Income Notes To Financial Statements Purpose

Profit And Loss Statement Balance Sheet Template Financial Reformulated Income Blank Form