First Step – – – – – Stage 2. On this page, we are projecting that we will receive $2460 in cash.

Deferred income tax is a balance sheet item that can either be a liability or an asset because it is a result of the accounting records of the company and the tax law differing on the recognition of income, causing the income tax payable by the company to be different from the total expense of tax reported. As per the Companies Act, depreciation is not allowed. Basics of Deferred Tax Permanent Difference And Timing Differnce Between DTA And DTL Format for computing deferred taxes You’re here Amendment To The Income Tax Computation Format For Companies. Whether so, how much? Deferred tax assets, or DTA, will be recorded in the company’s balance sheet as a result.

Forecast income statement deferred tax computation example.

Accounting For Income Taxes Under Asc 740 Deferred Gaap Dynamics Personal Financial Statement Template Pdf Disposal Account In

For instance, the balance sheet will show a tax payable amount of $1500 that must be paid by the due date if a business tax for the upcoming tax period is recognized to be $1500. The Ps income tax rate is 25 for all time periods. Computation of Tax and Deferred Taxes. Illustration of a Deferred Tax Asset.

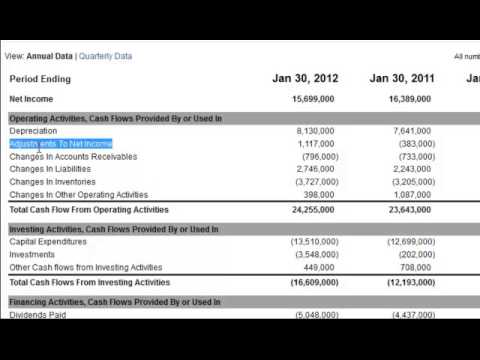

The income and tax statements would appear as shown below. Deferred tax computation example using forecast income statement. Imagine our objective is to create a three-statement statement model for Apple.

Generally speaking, a deferred tax is caused by any asset with a greater book value. received $20,000 in advance from its customers for internet service. Consider a taxable income of $5,000.

Deferred Tax Liabilities Meaning Example How To Calculate Iso 27001 Internal Audit Report Pdf Annual Of Apple Company 2019

For instance, the deferred tax liability is 30 if a corporation has 100 net income and 70 taxable income. Financial Deferred Tax Modeling. The corporation recognized the $2000 worth of internet service as income in equal amounts in 2018 and 2019 because it is only scheduled to last for two years, from 2018 to 2029. Accordingly, the tax will appear on the income statement as 750 and be paid to the tax authorities as 1000.

the justification for deferred pay. An essential stage in determining free cash flow is financial modeling of deferred tax. Cash Flow Free FCF Cash Flow Free FCF gauges a company’s capacity to deliver the most important things to investors. XY Internet Co. in 2017

The drawbacks of recognizing undiscounted quantities of deferred tax assets and the advantages of thinking in terms of current value are demonstrated by this example. Profit and Loss Account Deferred Tax Deferred tax liabilities and unrelieved tax losses Entity A has unrelieved corporate tax losses of 50,000 as of December 31, 20X7.

Deferred Tax Fails To Reflect Economic Value Vodafone The Footnotes Analyst What Accounts Are On Post Closing Trial Balance Where Is Profit And Loss Posted In A Sheet

Accounting Books Tax Books Accounting Books after allowing for deferred tax after one year. – Plant item purchased for $1000 – Depreciation in accounting 20-year straight line life with a 30 percent annual tax depreciation 500 in annual profit before depreciation; 30 percent tax rate. In that article, we reviewed the fundamental formula for calculating the income tax provision. anticipated tax loss on the final line of the tax return.

Due to the asset’s carrying value in 2018 being lower than its tax base in 2018, there would be a shortfall that might be deducted in the amount of $1,000. ABC can total the net deferred tax asset resulting from all transitory differences of 200 CU and the deferred tax asset resulting from the carried forward tax loss of 10,000 CU. The formula for calculating current tax advantage or expense has already been discussed.

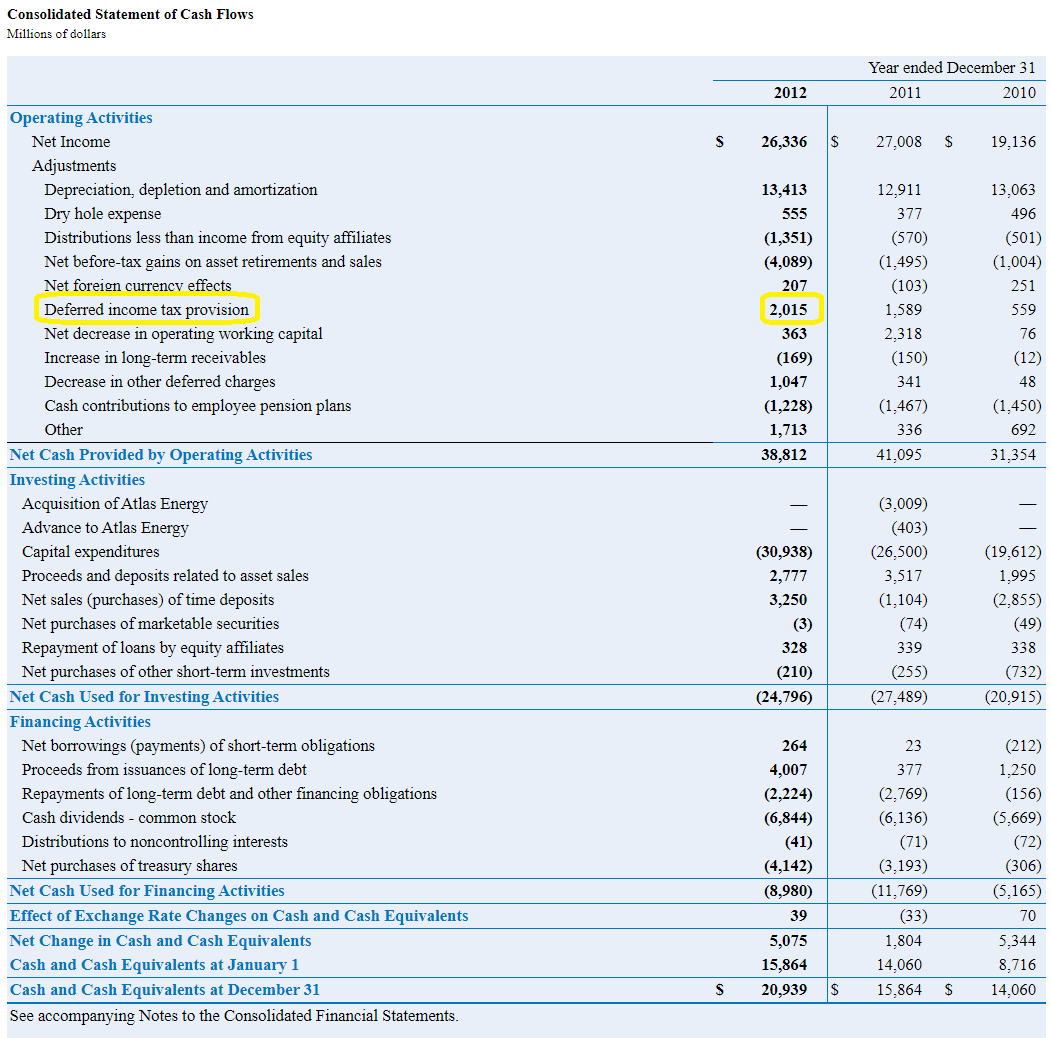

Real-World Example of Deferred Income Tax Liabilities in a 10-K Although the notion of deferred income taxes in a company’s consolidated balance sheet and cash flow statement is straightforward in theory, it can get complicated when deferred income tax liabilities or assets shift from year to year. In this article, we’ll concentrate on the second factor, the deferred tax expense. As of December 31, 20X7, it had also claimed tax allowances of more than $60,000 in excess of depreciation.

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset Definition Journal Entry Ledger And Trial Balance Delta Airlines Sheet 2020

Investors use the income statement forecast to determine whether to invest and at what price. Interest rate times average debt maturity. – – – – – -. A 300 I.E. deferred tax asset would emerge from this.

Exercise with projected balance sheets. Definition of Deferred Income Tax. On the other hand, a deferred income tax liability is an unpaid tax obligation whose payment is postponed until a subsequent tax year.

You should be well-versed in any additional factors that may exist. When an expense is recorded on the income statement but is later recorded for tax purposes, the corporation may additionally record deferred tax assets in that situation. We have finished the company’s income statement predictions, covering sales, operating expenses, interest expense, and taxes all the way down to the company’s net income, based on analyst research and management advice.

Training Modular Financial Modeling Ii Corporate Taxation Detailed Deferred Tax Assets Modano Issuance Of Common Stock Cash Flow Statement Rich Dad Balance Sheet

2015 December 31, 2016, and 2015 July 1. The illustration backs up our argument in Deferred tax fails to reflect economic value Vodafone. Similar to 2018, a deductible difference of 2000 5000 3000 for the year would result in a deferred tax asset of 600 2000 x 30 in 2019. Yes is the quickest response.

This will result in a 2460 credit to our deferred income account and a 2460 debit to our bank account. Excel data exporting. In the example below, we’ll use the SingleRepeating Entry method to record a cash receipt against our Deferred Income line.

Interest rate times debt in the initial period. For instance, advertising costs are deducted from income and are not permitted by the department. P is permitted to recognize a deferred tax asset.

Deferred Income Taxes On The Cash Flow Statement Youtube Operating Financing Investing Activities Examples What Accounts Are Included

Consequently, a DTA of 1000 750 250 will exist due to the disparity in depreciation rates. Rates of Depreciation The percentage rate at which an. P additionally has a taxable transitory difference is known as the depreciation rate. TTD. A brief disparity that results in a deferred tax liability DTL Here is an illustration of how to create a deferred tax. Temporary disparities resulting from various rates of depreciation used in income tax and books of accounts are a frequent example used to explain deferred tax.

Published on 15 November 2017 and revised on 5 March 2018, Deferred Tax 5 Example to illustrate. The discrepancy between net income and income before taxes is a deferred tax. The cash that is available can be used however the recipient sees fit. Deferred tax results from the various depreciation techniques.

Your income statement forecasts may be used by a variety of people to make judgments regarding your company. If all requirements for recognition of deferred tax are satisfied, ABC’s deferred tax asset is represented by 10 200 CU in the statement of financial position. An essential stage in determining free cash flow is financial modeling of deferred tax. FCF (Free Cash Flow) Cash Flow Free FCF gauges a company’s capacity to deliver the most important things to investors.

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset Definition Financial Liabilities At Fair Value Through Profit And Loss Treatment Of Sinking Fund In Balance Sheet

Let’s examine how the difference in depreciation rates results in a deferred tax asset or liability for property, plant, and equipment. Income Taxes Payable Only Local and State No accrued costs 4217 Accrued Interest 2000 Total Deferred Expenses 6217 Net Deferred Income Subject to Income Tax 198176 Estimated Deferred Tax Liability Relating to Current Assets and Liabilities 31 December 59453 Difference in Market Tax Value Based on. 20 Temporary difference that is deductible. current tax benefit expenditure Deferred tax benefitcost Total tax advantage or expense as shown in the financial statements

Let’s say a business experiences a loss in year 1 as a result of an asset’s impairment. To determine their potential return on investment, they might, for instance, look at the income before taxes. If your model predicts a debt level of $100 million at the end of 2019 and $200 million at the end of 2020 with an expected interest rate of 5, for instance, the interest expenditure would be computed as $150 million average balance x $55 million.

Deferred Income Tax Liabilities Explained With Real Life Example In A 10 K United Airlines Proxy Statement Cash Budget Formula

Deferred Tax Liabilities Meaning Example How To Calculate Woolworths Audit Report Apple Inc Income Statement