The boardroom table was under-depreciated over its useful life due to over estimating the scrap value andor the estimated useful life of the boardroom table. The asset may be sold at profit or loss.

Disposal of non-current assets When a non-current asset is sold there is likely to be a profit or loss on disposal. Loss on Disposal of Assets. The loss on disposal as the term suggests arises when assets are disposed of during the accounting year and the proceeds of sale are less than the book value. In most examinations you will be required to put through the accounting entries for the disposal of a.

Loss on disposal of non current assets.

Non Current Assets Held For Sale Annual Reporting Formula Retained Earnings Cash Flow Items

2014 000 2013 000. The accounting is done in following steps. Discrepancies between the register and the actual assetsshould he investigated and resolved. Karl Heyes is an agricultural contractor operating in North Yorkshire.

Disposals of non-current assets. Disposal of non-current assets When a non-current asset is sold there is likely to be a profit or loss on disposal. Loss on disposal.

Questions 1 a A business has sold one of its vans for 12280 plus VAT. Sale Proceeds – Cost – Accumulated Depreciation – Accumulated Impairment Losses If the result is positive it represents a gain on disposal. Proceeds from disposal of non-current assets.

Disposal Of Assets Accountingcoach Amortization On Income Statement P&l A Restaurant

Sale Proceeds – Carrying Amount. The disposal of assets involves eliminating assets from the accounting records. Cash of 20000 is received for the asset however the business still makes a loss on disposal of 1000 which is an expense in the income statement. Loss on disposal of a non-current asset is a cash outflow.

Transfer the accumulated depreciation of related asset to disposal account. Gain Loss on Disposal. Usual practice to record sale or disposal of non-current asset is done by opening a temporary account named Disposal Ac.

Want to see the full answer. Let us take a look at the accounting effect for the same. 10th Dec 2013 0745.

Is Accounting A Means And Not An End Explain Information Increase Consolidation Of Financial Statements Ifrs Where Does Common Stock Go On Balance Sheet

And if it is negative it shows a loss on disposal. Also it is a non-cash expense. The cash inflow on the non-current asset disposal is the cash that is actually received the sale proceeds from disposing of that non-current asset. Finally the fact that the asset has been disposed of must be recorded in the non-current asset register.

Have another go at calculating the correct profit or loss on disposal and the cash inflow from the disposal of this non-current asset. What gain or loss was made on the vans disposal. The non-current Assets Register.

January 15 2022. Since a non-current asset is used over a certain time frame therefore it is advisable to. Sales proceeds NBV profit on disposal Sales proceeds NBV loss on disposal.

Non Current Assets Overview Types And Examples Financial Performance Ratio Ipsas 14

Buses 89 1049 Otherwrite-off of non-current assets 17343 15 Net gainloss 15628 77. An asset disposal may require the recording of a gain or loss on the transaction in the reporting period when the disposal occurs. He commenced in business on 1 January 2016 and. If a company disposes of sells a long-term asset for an amount different from the amount in the companys accounting records the assets book value an adjustment must be made to the amount of net income appearing as the first item on the SCF.

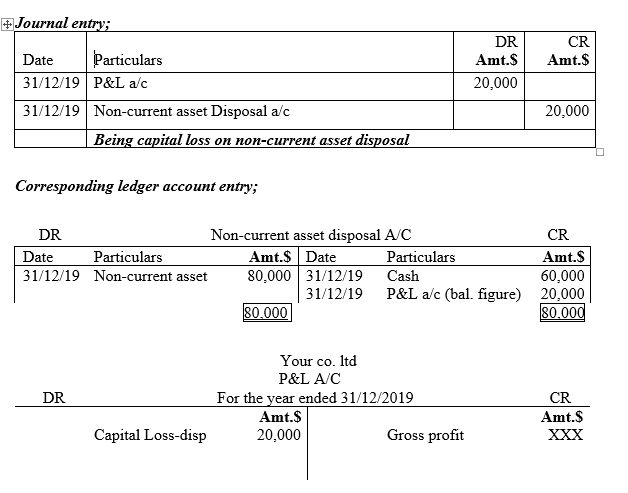

Which International Financial Reporting Standard deals with tangible assets that are depreciated over their useful economic life. On making capital loss on disposal of the non-current asset see case b cash received was 60000 If cash is actually received whether hard cash or check make the corresponding entries in the non-current asset disposal account and the cashbook which can take the form of either cash account or bank account. This is the difference between the net sale price of the asset and its net book value at the time of disposal.

This is the difference between the net sale price of the asset and its net book value at the time of disposal. In accordance with prudence and matching concept. Nearly all the smallest organisations keep a non current register.

Fixed Asset Accounting Education Kroger Financial Statements The Big Five Audit Firms

Disposal 20X7 20X7 Jan 1 Machinery 24000 Jan 1 Accumulated Depreciation 9600 1 Cash 12950 Dec 31 Profit and loss loss on disposal 走 1450 24000 24000 C. Sales proceeds NBV profit on disposal Sales proceeds NBV loss on disposal Accounting Treatment. Profit or Loss on Disposal of Asset The assets used in the business can be sold anytime during their useful life. The assets book value has little relationship with its fair market value.

This is needed to completely remove all traces of an asset from the balance sheet known as derecognition. Profit or a loss on disposal which must be accounted for. Transfer the asset to disposal account Debit.

The actual cash inflows and outflows associated first with the assets purchase followed by the assets disposal are accounted for on the cash flow statement as investing cash flows. To illustrate assume a company sells one of its delivery trucks for 3000. Disposal account 200000 Credit.

Accounting Nest Advanced Acquisition And Disposal Of Non Current Assets P&l Analysis Example Fye Financial Statement

It is not necessary to keep an asset until it is scrapped. Amount Gainloss b A business has sold a building for 289500 plus VAT. Depreciation is the loss of noncurrent assets and is charged to spread the cost of an asset over its useful life. The profit on disposal is negative indicating that the business actually made a loss on disposal of the asset.

CH18 DISPOSAL OF NON-CURRENT ASSETS 13 c. Net gainloss on disposalwrite-off of non-current assets. On the disposal of asset accounting entries need to be passed.

Costs of disposal of non-current assets. The asset disposal results in a direct effect on the companys financial statements. The impairment is a reduction in the carrying value of an asset that is still held at the balance sheet date.

Small Business Income Statement Template Lovely Layout In E Temp Budget Profit And Loss What Is A Balance Sheet Of Cash Flows Accounts Payable

The van originally cost 29730 and accumulated depreciation of 16482 has been charged against it. Cash inflows from disposal of fixed assets is reflected in the cash flows from investing activities section of the. Check out a sample QA here. Also if a company disposes of assets by selling with gain or loss the gain and loss should be reported on the income statement.

Disposal of non-current assets. The proceeds of disposal 200 the market-value was less than the carrying-value of the non current asset 400. The fixed assets disposal journal entry would be as follows.

Double Entries for Disposal of Non-current Assets with Trade-in Allowance Sometimes an old asset is disposed of in exchange for a new asset. The profit or loss on the disposal of a non current asset is the difference between The net book value of the asset and Its net sale price. Loss on disposal of a non-current asset is a cash outflow.

Difference Between Cost Of Goods Sold And Services P S Marketing Accounting Trial Balance Sheet Example A Company

Philip Dunn tests your knowledge of this important concept. It is a listing of all. In all scenarios this affects the balance sheet by removing a capital asset.

What Is Capital Structure And Why It Matters In Business Fourweekmba Cash Flow Statement Financial Walmart Audit Report How To Read Corporate Statements

/ExxonLongtermAssets2018-5c5485414cedfd0001efdb2c.jpg)