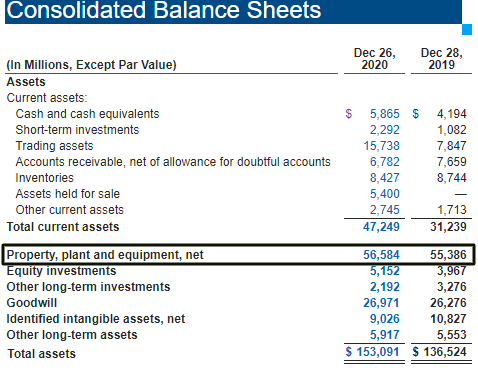

It can also be referred to as a statement of net worth or a statement of financial position. IAS 138A requires an entity to present at a minimum.

This expense is tax-deductible so it reduces your business taxable income for the year. Less accumulated depreciation NOTE 5 ACCOUNTS PAYABLE. A credit to a contra-asset increases the value of the account while a debit decreases its value. It expects the salvage value of net book value to be 10000.

Statement of financial performance accumulated depreciation balance sheet example.

Solved Balance Sheet Use The Data From Following Chegg Com Financial Statement Note Disclosure Examples Nonprofit Board Reports

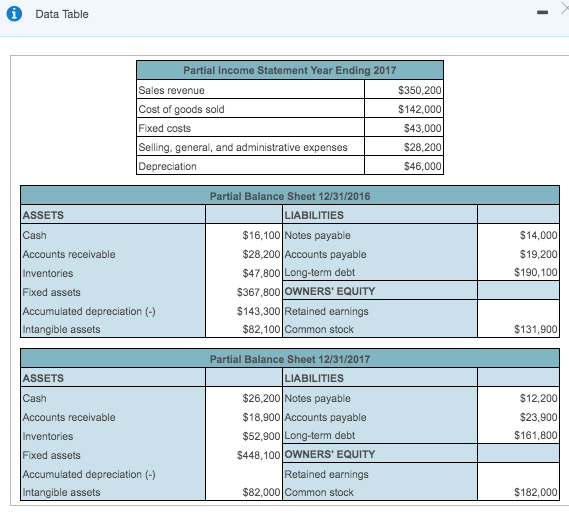

Balance sheet Balance Sheet A balance sheet is one of the financial statements of a company that presents the shareholders equity liabilities and assets of the company at a specific. FINANCIAL STATEMENTS DECEMBER 3120X1 SAMPLE FINANCIAL STATEMENTS. By calculating and itemizing their assetswhat they ownand liabilitieswhat they owe they are able to make calculated financial decisions for the wellbeing and future success of their business. It reports a companys assets liabilities and equity at a single moment in time.

A classified balance sheet is a financial statement that reports asset liability and equity accounts in meaningful subcategories for readers ease of use. Balance sheet CURRENT ASSETS. Accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time.

Depreciation is a means by which we convert a capitalized. Indicate whether the following items in a bank reconciliation should be a. Accumulated depreciation 95578 100120.

Accumulated Depreciation Explained Bench Accounting Profit On Sale Of Asset Journal Entry Salesforce Financial Statements

Using our example after one month of use the accumulated depreciation for the displays will be 1000. The balance sheet is based on the fundamental equation. Assets Liabilities Equity. The cost for each year you own the asset becomes a business expense for that year.

However an entity may use other titles eg balance sheet instead of statement of financial position for the statements identified in IAS 1 IAS 110. A balance sheet is an important financial document businesses use to understand their financial status. Those assets list on the balance sheet at cost which is 250000.

The Example Financial Statements use the terminology in IAS 1 Presentation of Financial Statements. The depreciation reported on the balance sheet is the accumulated or the cumulative total amount of depreciation that has been reported as depreciation expense on the income statement from the time the assets were acquired until the date of the balance sheet. So to use our above example if Walmart purchases an asset for 250000.

How Is Accumulated Depreciation Represented In The Balance Sheet As A Negative Credit Asset Or Positive Debit Liability Quora Annual Income Statement Example Prepare Trading And Profit Loss Account

Instead of realizing a large one-time expense for that year the company subtracts 1500 depreciation each year for the next five years and reports annual earnings of 8500 10000 profit minus 1500. You can think of it like a snapshot of what the business looked like on that day in time. This also leads to a decrease in the assets met book value. A business purchases a computer fixed asset at 70000 after three years of useful life.

It shows the beginning balances of every account to be used to start the new years records. Sample Financial Statement Comparisons Keywords. In other words it breaks down each of the balance sheet accounts into smaller categories to create a more useful and meaningful report.

An example of net value is as follows. Financial Statements The Depreciation expense is presented on an income statement as an operating expense and the Accumulated Depreciation contra asset account is captured on a balance sheet under capital assets as a deduction from Property Plant and Equipment non-current fixed assets. The correct Answer is option2.

Depreciation Expense Accountingcoach Infy Balance Sheet Llp Format 2019 In Excel

Accumulated depreciationNet book value is the cost of an asset subtracted by its accumulated depreciation. The cost each year then is 1500 7500 divided by five years. The balance sheet displays the companys total assets and how the assets are financed either through either debt or equity. The answer is2.

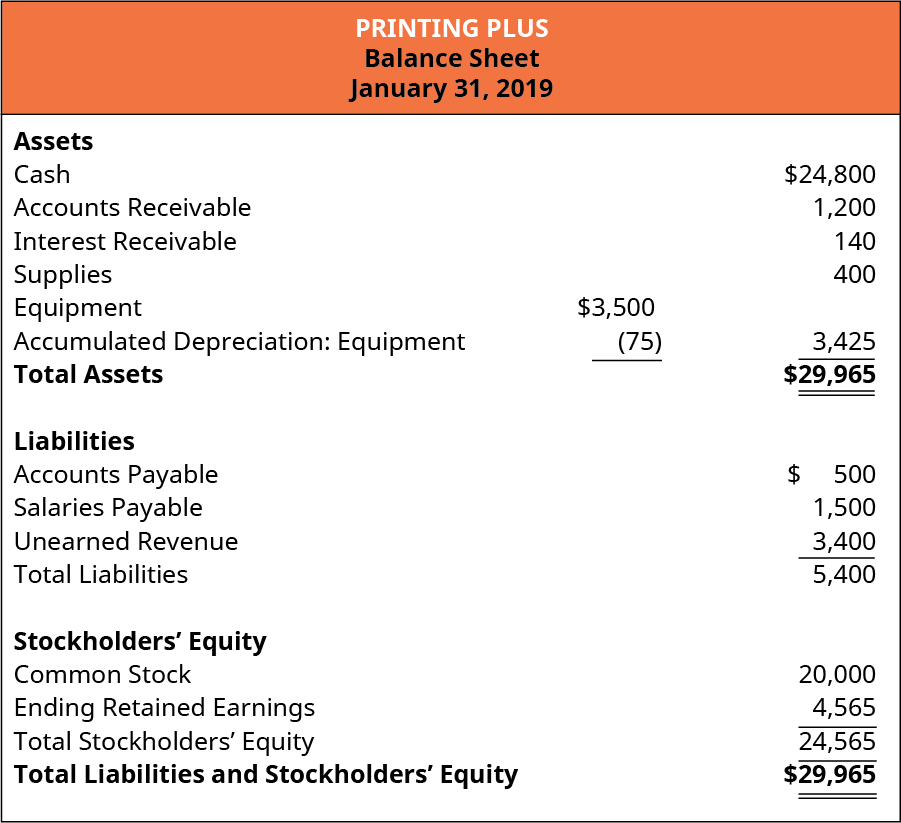

The accounting equation is balanced as shown on the balance sheet because total assets equal 29965 as do the total liabilities and stockholders equity. Deducted from the checkbook balance. Deducted from the bank statement balance.

Accumulated Depreciation TOTAL ASSETS CURRENT LIABILITIES. Accumulated depreciation also impacts the book value of the company. When depreciation expense is recorded on the income statement of a company the same amount is also credited to the accumulated depreciation account on the balance sheet.

Balance Sheet Long Term Assets Accountingcoach Stocks With The Best Sheets Company Template

The balance sheet also called the statement of financial position is the third general purpose financial statement prepared during the accounting cycle. For example a company purchased a piece of printing equipment for 100000 and the accumulated depreciation is 35000 then the net book value of the printing equipment is 65000. FRF for SMEs financial reporting framework financial reporting comparison document. CIDER HILL PLAYERS STATEMENT OF FINANCIAL POSITION DECEMBER 31 2009 AND 2008.

Added to the checkbook balance. It is the source document from which to prepare the financial statements. At the same time the credit increases the asset contra account of accumulated depreciation which will flow through to the balance sheet statement of financial.

It will recorded in the balance sheet if we book the fixed assets on cost basis otherwise accumulated depreciation is deducted from the cost price of the assets in the depreciation chart booked the assets on WDV. The balance sheet – also called the Statement of Financial Position – serves as a snapshot. BALANCE SHEET EXAMPLE 1.

/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

Why Is Accumulated Depreciation A Credit Balance Deferred Revenue On Cash Flow Statement Three Financial Sheets

There are three major financial statements. The accumulated depreciation 75 is taken away from the original cost of the equipment 3500 to show the book value of equipment 3425. Added to the bank statement balance. Outstanding deposit of 1200.

ACCOUNTANTS REVIEW REPORT FINANCIAL STATEMENTS Balance Sheet Statement of Income and Retained Earnings Statement of Cash Flows Notes to Financial Statements. Accounts Payable Depreciation Insurance Rent Utilities CASH FLOWS FROM OPERATING ACTIVITIES. The debit creates the depreciation expense for the year which we will see in the statement of financial performance also called the income statement or profit and loss statement.

It proves that transactions have been posted correctly. For example accumulated depreciation impacts the net book value of the assets. Each example of the financial statement states the topic the relevant reasons and additional comments as needed.

Adjusting Entries For Asset Accounts Accountingcoach What Is Profit And Loss Account Definition Certified Balance Sheet

The total accumulated depreciation over the assets lifetime is on the balance sheet.

The Basics Of Depreciation In Income Statement And Balance Sheet Difference Format Account

Prepare Financial Statements Using The Adjusted Trial Balance Principles Of Accounting Volume 1 Goeasy Stock Debit Or Credit In